Plus we explain what a credit score is

Your credit score directly affects many facets of your financial well-being. However, did you know that there are free credit score check tools online that can help you monitor your credit score?

This post will help you visualize your current financial health by listing the most popular platforms to check your credit score for free. It will also discuss what a credit score is and how several institutions rate your credit.

What’s a Credit Score?

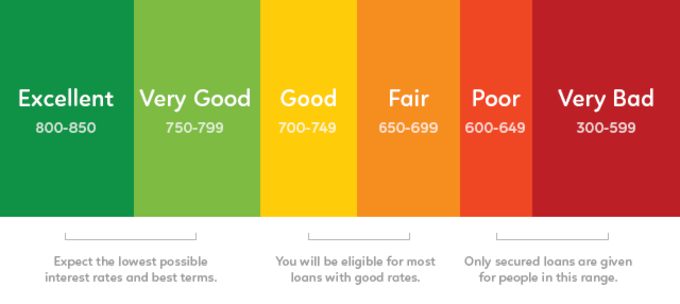

A credit score is usually a number 300 and 850 that creditors and other financial institutions use to determine the health of your finances.

This score is calculated using different factors, such as:

- Payment history

- The credit cards you own

- Your credit inquiries

- Credit usage

- The length of your credit history

Your credit score may also be used by landlords, employers, and insurance companies to determine how they transact with you.

The higher your credit score, the more likely these institutions will approve your loan, mortgage, and other monetary transactions. However, a lower score will make it less likely for your loans to be approved or have you pay more in interest.

FICO vs. Non FICO Credit Score

A Fair Isaac Corporation (FICO) score is what most lenders use to determine whether you’re a credit risk or not. The three major credit bureaus, namely Equifax, Experian, and TransUnion, use FICO scores based on your credit history.

In contrast, a non-FICO score doesn’t use the same calculations as the top lenders. As such, the two scores often don’t match and could even have a score difference of 100 or more in some cases. While that may be the case, knowing your credit score can still give you an idea of where your financial health stands.

VantageScore is one of the most popular non-FICO scoring systems. Their recent VantageScore 3.0 and 4.0 have adopted the same 300- 850 scale used by FICO.

For reference, a good FICO score is anything above 670. Meanwhile, if you are using the non-FICO scale, a score of 700 and above is considered good credit.

Best Platforms to Check Credit Score for Free

1. Credit Karma

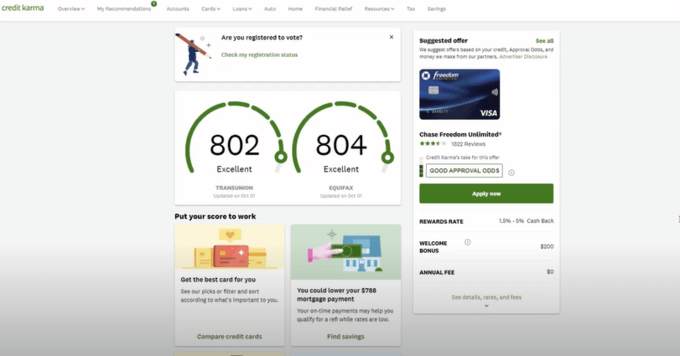

Signing up for a free account on Credit Karma takes a few steps, including verifying your identity to see your information.

Credit Karma shows you two scores. One is based on your Equifax report, and the other is based on your TransUnion report. The two scores are slightly different depending on how often each bureau updates your account.

The best thing about Credit Karma is that they have a Credit Score Simulator. You can use this tool to get a preview of how your credit would change if you get a new loan, open new credit, or do other similar actions.

2. Credit Sesame

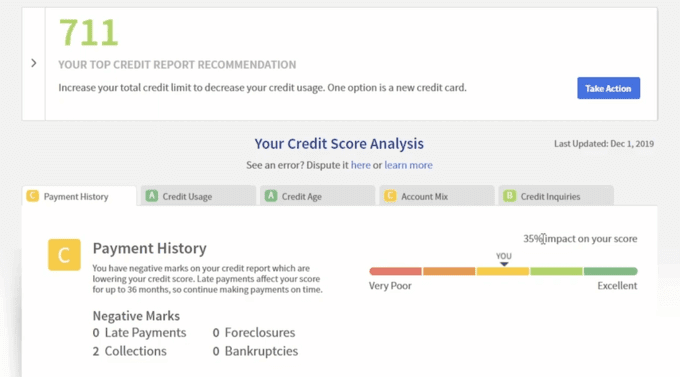

Creating an account on this platform is very similar to Credit Karma. However, Credit Sesame only gives your TransUnion report. Despite this feature, their site still offers valuable information about your credit score. It also has useful features such as a debt analysis tool and credit monitoring.

Credit Sesame has a debit account wherein they offer a bit of incentive when you increase your credit score. The platform also provides suggestions on how you can improve your credit score.

Furthermore, Credit Sesame grades your past actions and tells you how they affected your score. One downside of Credit Sesame is that they update your credit score only every month, whereas some other platforms do it in a week.

3. CreditWise

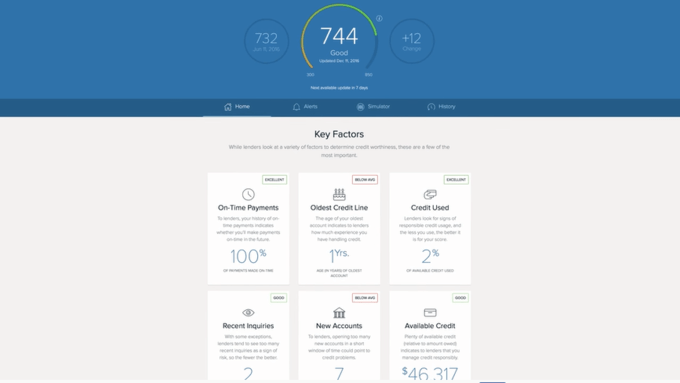

CreditWise by CapitalOne provides a VantageScore 3 by TransUnion. However, they don’t offer any rating from Equifax. The platform updates your credit score every seven days and has a credit simulator much like Credit Karma.

The best thing about this service is that they don’t promote any pre-qualified credit cards or insurance rates. You also don’t need to have a CapitalOne credit card or bank account to use the platform.

Moreover, CreditWise provides some helpful credit improvement suggestions, which are beneficial if you’ve just started a credit. The main downside of their service, though, is you only get a partial glimpse of your total credit profile based on the TransUnion report.

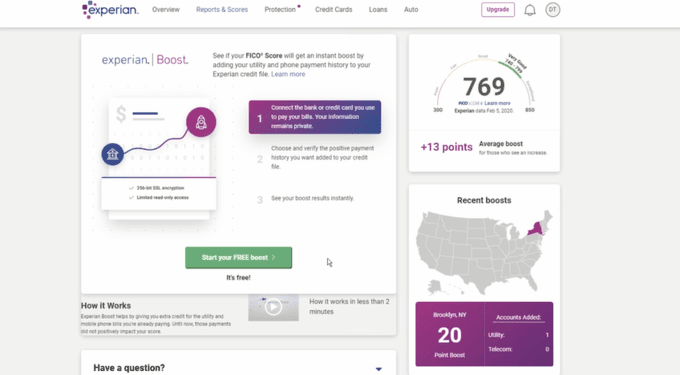

4. Experian

Experian is one of the few apps that let you get access to your FICO score for free. They update your score monthly or whenever there’s a significant change to your credit score.

The app also has the Experian Boost feature, which allows you to gain good credit if you have good standing utility bills and on-time rent. Experian has excellent credit monitoring notifications similar to its main rivals.

The main advantage of Experian is they provide more than just one FICO score. They cover different bank scores, auto scores, and more. You can file a dispute on negative items on your report using the app. However, Experian is known to over-promote its premium services to its users.

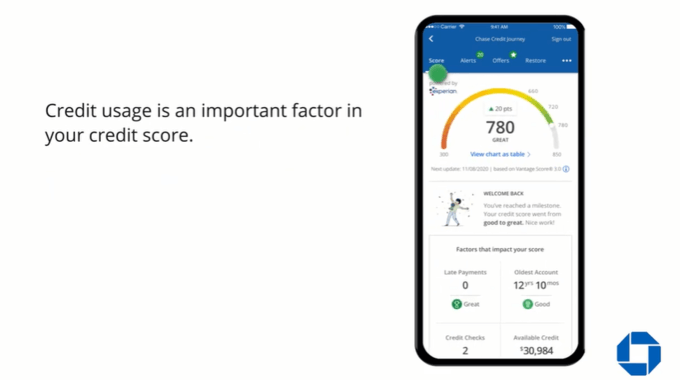

5. Chase’s Credit Journey

This free credit tracking tool can be accessed using your Chase account. Credit Journey updates your credit score every week and has useful features to help you understand how your spending affects your overall score.

The score is based on the VantageScore 3.0 model, which many insurance companies and banks use. Credit Journey’s most significant advantage is that it can pre-qualify for offers from Chase. Hence, you can get bigger rewards over time, but these are still subject to approval.

Another advantage of this tool is its ability to store all financial data in just one place. However, much like Experian, the only main con with using this tool is receiving many credit offers from Chase.

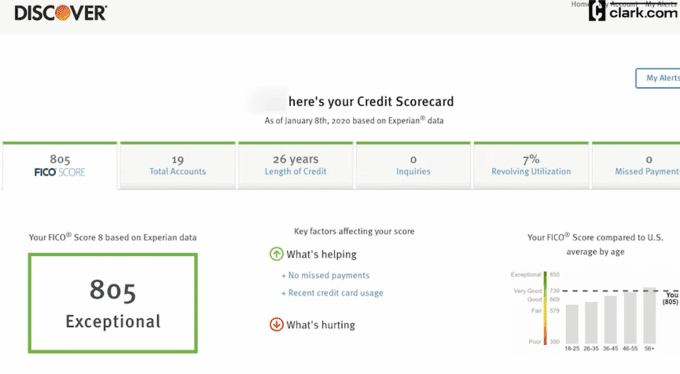

6. Discover Scorecard

Even if you don’t bank with Discover, you can still use this service to check your credit score. You just have to sign up for a free account and provide the necessary information to verify your identity. Once your account is approved, you can see your FICO score based on your Experian credit report will be available.

The platform lets you see your total number of accounts, the length of your credit history, and the number of inquiries you currently have. It also shows your missed payments and revolving utilization.

Unlike other free FICO score websites, Discover doesn’t pressure you to sign up for paid products.

7. Your Credit Card Issuer

The company that issued your credit card allows you to see your FICO credit score. If you want to check your credit score, you can log in to your online account or call the toll-free number that’s on the back of your credit card.

Some credit card companies also show your credit score on the paper statement they send each month.

What’s Your Score?

These are just a few ways to check credit scores for free or with a minimal fee. Other tools on the market offer the same service, albeit not as effective or neatly outlined as those on this list.

If you want to keep your finances healthy, make sure to check your credit score before making huge financial decisions.